Under the Patient Protection and Affordable Care Act (PPACA or Affordable Care Act), employers that are subject to the Fair Labor Standards Act are required to provide a new notice to employees.

Notice to Employees of Exchange Coverage Options

A “Notice to Employees of Exchange Coverage Options” must be given to inform employees of health care coverage options that are available to the employees. The notice is intended to allow the employee to evaluate the employer’s plan against health care plans that may be available in market place exchanges.

It is important to note that:

- This notice must be given beginning October 1, 2013, to new employees.

- Existing employees must also receive the notice no later than October 1, 2013.

- The notice must be given to all employees, including part-time employees.

- The notice is required even if the employer is a small employer under the Affordable Care Act and below the threshold of fifty (50) employees, as long as the employer is subject to the FLSA.

- The notice must be provided even if the employer does not provide employer-sponsored health insurance or if health insurance is provided and the employee is not enrolled in the plan.

There is one notice for employers sponsoring a health care plan and another for employers not sponsoring a plan.

Click here to access the notice for Employers WITH Plans on the Department of Labor website.

Click here to access the notice for Employers WITHOUT Plan on the Department of Labor website.

Updated Model Election Notice Under COBRA

A new “Updated Model Election Notice Under COBRA” must also be given to employees beginning January 1, 2014. The model notice has been updated to include additional information about health care coverage that is available through exchanges.

Click here to access a sample notice on the Department of Labor website.

For more information about the PPACA or any related area of law, please contact Mark Samila at (812) 423-3183 or MSamila@KDDK.com, or contact any member of the KDDK Tax and Employee Benefits Law Practice Team.

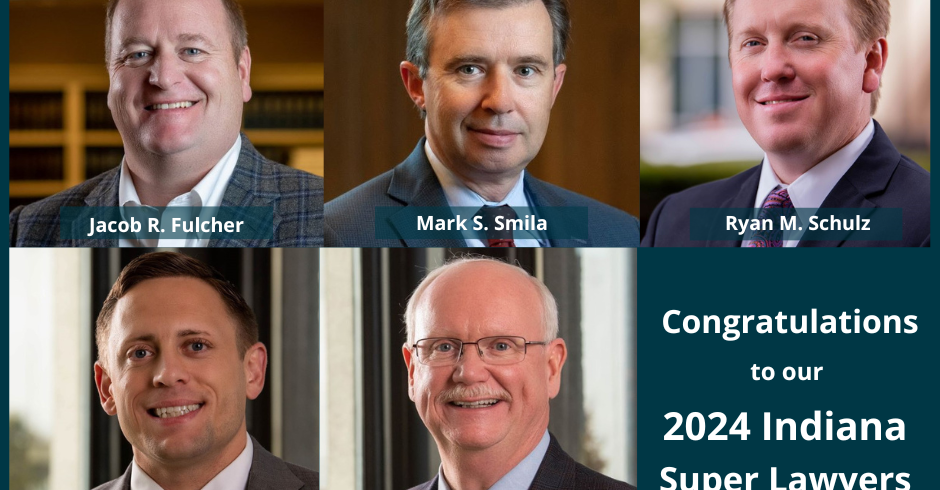

About the Author

Mark S. Samila, a Partner at Kahn, Dees, Donovan & Kahn, LLP, in Evansville, Indiana, is a business attorney, Indiana Registered Civil Mediator and Licensed Certified Public Accountant (Missouri) whose practice includes tax and estate planning, financial services including bank and bond financing, creditors’ rights, workouts and bankruptcy and business law. Mark blends his accounting and financial background with his legal experience. In so doing, he provides legal analysis and also understands and considers the business and financial implications of a client’s legal options.